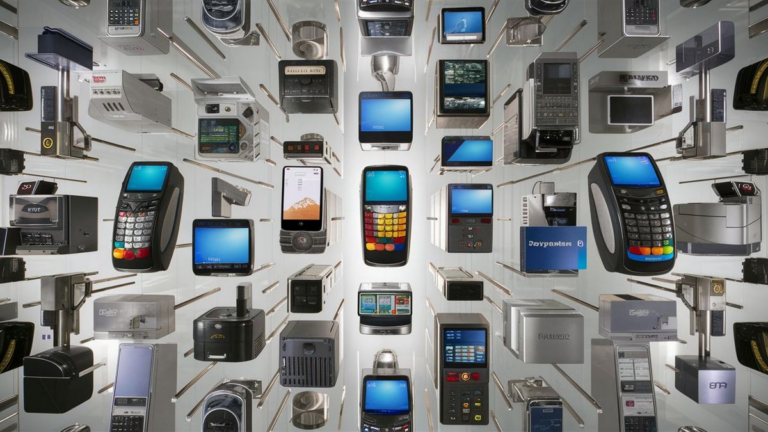

When it comes to finding the best credit card processing companies, businesses are faced with a multitude of options. Selecting the right company can significantly impact a business’s bottom line, customer satisfaction, and overall efficiency. We understand the importance of this decision and have curated a comprehensive guide to assist you in making an informed choice.

The Importance of Choosing the Right Credit Card Processing Company

Credit card processing is a critical component of modern commerce. With the majority of transactions being conducted electronically, businesses need a reliable and efficient payment processing solution. The right credit card processing company can streamline transactions, provide robust security measures, and offer competitive pricing, ultimately enhancing the overall customer experience.

Factors to Consider

When evaluating credit card processing companies, there are several key factors to consider:

- Transaction Fees: Assess the various fees associated with each company, including interchange fees, flat rates, and monthly subscriptions.

- Payment Processing Methods: Determine whether the company supports various payment methods, such as EMV chip cards, mobile payments, and online transactions.

- Security Measures: Ensure that the company implements stringent security protocols to protect sensitive customer data and mitigate the risk of fraud.

- Customer Support: Evaluate the quality of customer support services, including responsiveness, availability, and expertise.

- Integration Capabilities: Consider whether the company’s payment processing solutions integrate seamlessly with existing POS systems and e-commerce platforms.

Top Credit Card Processing Companies

After extensive research and analysis, we have identified some of the best credit card processing companies in the industry:

| Company | Features | Pricing |

|---|---|---|

| Stripe | Flexible API, extensive integrations, advanced fraud detection | Transparent pricing with no monthly fees, competitive transaction rates |

| Square | User-friendly interface, customizable POS solutions, next-day funding | Flat-rate pricing, no long-term contracts, free mobile card reader |

| Authorize.Net | Robust security features, recurring billing, virtual terminal | Interchange-plus pricing, monthly gateway fee |

Choosing the best credit card processing company for your business is a decision that requires careful consideration. By evaluating factors such as transaction fees, payment processing methods, security measures, customer support, and integration capabilities, you can select a provider that meets your specific needs and enhances your overall operations. With the right partner, you can streamline transactions, improve customer satisfaction, and drive business growth.

Frequently Asked Questions

Here are some commonly asked questions about credit card processing companies:

- What are interchange fees?

- How do security protocols protect sensitive data?

- Can I integrate credit card processing with my existing accounting software?

- What are some alternative payment methods besides credit cards?

Interchange Fees Explained

Interchange fees are charges imposed by credit card networks like Visa and Mastercard for processing transactions. These fees typically consist of a percentage of the transaction value plus a flat fee. They are paid by the merchant’s bank to the cardholder’s bank to cover the costs of processing the transaction and managing the network.

Enhancing Security Measures

Security protocols employed by credit card processing companies involve encryption techniques, tokenization, and compliance with Payment Card Industry Data Security Standard (PCI DSS). These measures safeguard cardholder data during transmission and storage, reducing the risk of unauthorized access and fraud.

| Question | Answer |

|---|---|

| What are interchange fees? | Interchange fees are charges imposed by credit card networks for processing transactions. |

| How do security protocols protect sensitive data? | Security protocols use encryption and tokenization to safeguard cardholder data. |

| Can I integrate credit card processing with my existing accounting software? | Many credit card processing companies offer integration with popular accounting software. |

| What are some alternative payment methods besides credit cards? | Alternative payment methods include mobile wallets, ACH transfers, and cryptocurrency. |

See also: